The 2025 tax season in the United States is about to begin, and the Internal Revenue Service (IRS) is expected to start processing tax returns for the 2024 fiscal year by the end of January. This year, the IRS continues to offer various tax relief programs to reduce tax liabilities or increase refunds, including the Saver’s Credit, which could reach up to $2,000.

According to the IRS, this credit is designed for individuals who make eligible contributions to retirement accounts, such as IRAs or employer-sponsored plans, as well as to ABLE accounts for individuals with disabilities. “You may be eligible for a tax credit for making eligible contributions to your IRA or employer-sponsored retirement plan. Additionally, you may be eligible for a credit for contributions to an Achieving a Better Life Experience (ABLE) account, if you are the designated beneficiary”, the agency states.

How to know if I am eligible for the Saver’s Credit?

According to the Internal Revenue Service (IRS), you may qualify for the Saver’s Credit if you meet the following requirements:

- You are 18 years old or older,

- You are not claimed as a dependent on someone else’s tax return, and

- You are not a student.

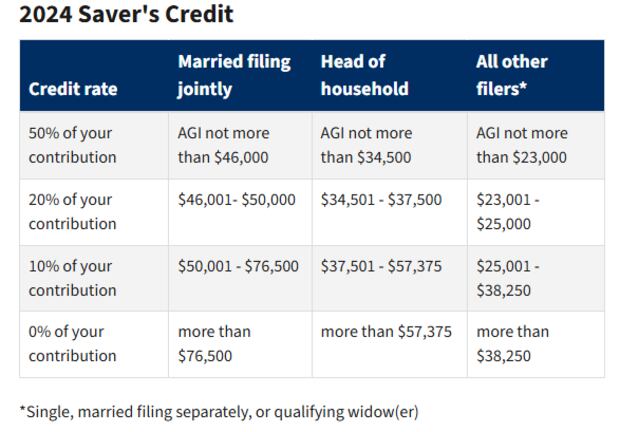

According to the IRS, the amount of this credit is determined based on your adjusted gross income reported on Form 1040. The percentage of the credit can be 50%, 20%, or 10% of the following:

- Contributions made to a traditional or Roth IRA arrangement

- Contributions through elective salary deferrals to a plan under section 401(k), 403(b), 457(b), SARSEP, or SIMPLE

- Voluntary employee contributions with after-tax compensation to a qualified retirement plan (including the Thrift Savings Plan) or a plan under section 403(b)

- Contributions to a plan under section 501(c)(18)(D)

- Contributions to an ABLE account for which you are the designated beneficiary (since 2018)

It is important to note that reinvestment contributions are not eligible for this credit. Additionally, the amount of your qualified contributions may be reduced if you have recently received a distribution from a retirement plan, an IRA arrangement, or an ABLE account.

The maximum contributions that can qualify for the credit is $2,000 ($4,000 for married couples filing jointly). As a result, the maximum credit you can receive is $1,000 ($2,000 for married couples filing jointly). Please refer to the income table to determine the percentage of the credit that applies to you.

To claim the Saver’s Credit, you must use Form 8880, titled “Credit for Qualified Retirement Savings Contributions,” as an attachment to your Form 1040.

YOU MAY BE INTERESTED IN

- What time to watch Squid Game season 2 on Netflix? Confirmed time in different countries for the premiere

- ◉ 50 Modern and New Christmas Songs That Are Just As Good as the Classics

- ◉ Top 100 Merry Christmas phrases to send to your family & friends this Dec 25th on Christmas Eve

- May distance not be an obstacle: the best phrases and messages to send at Christmas

:quality(75)/author-service-images-prod-us-east-1.publishing.aws.arc.pub/elcomercio/f98ec627-7558-4dcc-95a1-3f7c396b15b8.jpg)